Amazon just announced a blowout second quarter in terms of revenue growth, but it remains to be seen how investors will react short- and longer-term to the fact that the company is plowing huge amounts of cash into building infrastructure and fulfillment capacity to continue its growth in market share. As we’ve said before, we believe that Amazon is well on the way to owning half of the retail book business in the U.S. by 2013.

Kindle sales accelerated compared with the first quarter.

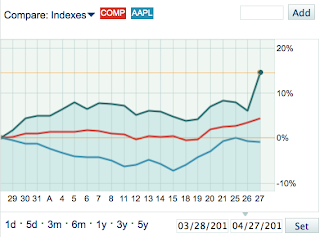

At 4:47 pm Eastern AMZN shares were trading above $227 per share, about 3 percent above the previous all-time high for the stock. The share price was $214.18 when the markets closed at 4 pm today.

Here’s Amazon’s press release:

Amazon.com Announces Second Quarter Sales up 51% to $9.91 Billion

SEATTLE, Jul 26, 2011 (BUSINESS WIRE) — Amazon.com, Inc. (NASDAQ:AMZN) today announced financial results for its second quarter ended June 30, 2011.

Operating cash flow increased 25% to $3.21 billion for the trailing twelve months, compared with $2.56billion for the trailing twelve months ended June 30, 2010. Free cash flow decreased 8% to $1.83 billion for the trailing twelve months, compared with $1.99 billion for the trailing twelve months ended June 30, 2010.

Common shares outstanding plus shares underlying stock-based awards totaled 468 million on June 30, 2011, compared with 465 million a year ago.

Net sales increased 51% to $9.91 billion in the second quarter, compared with $6.57 billion in second quarter 2010. Excluding the $477 million favorable impact from year-over-year changes in foreign exchange rates throughout the quarter, net sales would have grown 44% compared with second quarter 2010.

Operating income was $201 million in the second quarter, compared with $270 million in second quarter 2010. The favorable impact from year-over-year changes in foreign exchange rates throughout the quarter on operating income was $28 million.

Net income decreased 8% to $191 million in the second quarter, or $0.41 per diluted share, compared with net income of $207 million, or $0.45 per diluted share, in second quarter 2010. Second quarter 2011 net income was positively impacted by equity-method investment activity of $15 million, including a $49 million gain on the sale of an equity position partially offset by $34 million in losses from equity-method investments.

“Low prices, expanding selection, fast delivery and innovation are driving the fastest growth we’ve seen in over a decade,” said Jeff Bezos, founder and CEO of Amazon.com. “Kindle 3G with Special Offers has quickly become our bestselling Kindle at only $139. Customers love the convenience of a 3G reader — no hunting for or paying for Wi-Fi hotspots. Amazon picks up the tab for the 3G wireless, so you have no monthly payments or annual contracts.”

Highlights

- Sales growth of Kindle devices accelerated in second quarter 2011 compared to first quarter 2011.

- Since AT&T agreed to sponsor screensavers, Kindle 3G with Special Offers is now our bestselling Kindle device – at only $139. With Kindle 3G, there’s no wireless set up and no paying or hunting for Wi-Fi hotspots. Kindle 3G’s always-on global wireless connectivity means that wherever you are, you can download books and periodicals in less than 60 seconds and start reading instantly. Amazon pays for Kindle’s 3G wireless connectivity, which means the convenience of 3G comes with no monthly fees, data plans or annual contracts.

- Amazon.com announced the launch of Kindle Textbook Rental, offering students savings of up to 80% off textbook list prices. Tens of thousands of textbooks are available for the 2011 school year. In addition, Kindle Textbook Rental offers the ability to customize rental periods to any length between 30 and 360 days, so students only pay for the specific amount of time they need a book.

- The U.S. Kindle Store now has more than 950,000 books, including New Releases and 110 of 111 New York Times Bestsellers. Over 800,000 of these books are $9.99 or less, including 65 New York Times Bestsellers. Millions of free, out-of-copyright, pre-1923 books are also available to read on Kindle.

- The Company launched MyHabit.com, a membership-only fashion destination offering up to 60 percent off list prices of designer and boutique brands in women’s, men’s and children’s departments, with the convenience of free, instant membership; fast, free shipping and free return shipping in the U.S. on eligible items; and fast, $15 international shipping.

- Amazon.com announced that customers will be able to stream TV shows from CBS’s vast library. Amazon Prime customers will be able to instantly watch thousands of episodes from the CBS library at no additional cost to their membership. With the deal, Amazon will add 2,000 episodes to grow the total number of Prime instant videos to more than 8,000 movies and TV shows. Starting this summer, dozens of CBS shows will also become available to Amazon Instant Video customers.

- The Company announced three enhancements to Amazon Cloud Drive and Cloud Player: storage plans that include unlimited space for music, free storage for all Amazon MP3 purchases and Cloud Player for Web, now on iPad.

- Amazon announced that Marketplace sellers can list their products across all its European websites using just one single seller account, allowing sellers to make their inventory available across Amazon.co.uk, Amazon.de, Amazon.fr and Amazon.it. Customers benefit from access to millions of additional products. Fulfillment by Amazon (FBA) sellers can now also store their products in an Amazon fulfillment center in one country and offer them for sale across all of Amazon’s European websites.

- North America segment sales, representing the Company’s U.S. and Canadian sites, were $5.41 billion, up 51% from second quarter 2010.

- International segment sales, representing the Company’s U.K., German, Japanese, French, Chinese and Italian sites, were $4.51 billion, up 51% from second quarter 2010. Excluding the favorable impact from year-over-year changes in foreign exchange rates throughout the quarter, sales grew 36%.

- Worldwide Media sales grew 27% to $3.66 billion. Excluding the favorable impact from year-over-year changes in foreign exchange rates throughout the quarter, sales grew 20%.

- Worldwide Electronics and Other General Merchandise sales grew 69% to $5.89 billion. Excluding the favorable impact from year-over-year changes in foreign exchange rates throughout the quarter, sales grew 62%.

- Amazon Web Services (AWS) and SAP announced that AWS has been certified as a global technology partner of SAP. Customers can now deploy a variety of SAP solutions in full production environments including SAP(R) Rapid Deployment and SAP(R) BusinessObjects(TM).

- AWS announced the availability of Amazon Relational Database Service (RDS) for Oracle databases, allowing customers to easily set up, operate and scale fully managed Oracle databases in the cloud.

- AWS lowered prices for the fifteenth time in four years by eliminating inbound Internet data transfer costs and reducing outbound data transfer costs.

Financial Guidance

The following forward-looking statements reflect Amazon.com’s expectations as of July 26, 2011. Our results are inherently unpredictable and may be materially affected by many factors, such as fluctuations in foreign exchange rates, changes in global economic conditions and consumer spending, world events, the rate of growth of the Internet and online commerce and the various factors detailed below.

Third Quarter 2011 Guidance

- Net sales are expected to be between $10.3 billion and $11.1 billion, or to grow between 36% and 47% compared with third quarter 2010.

- Operating income is expected to be between $20 million and $170 million, or between 93% decline and 37% decline compared with third quarter 2010.

- This guidance includes approximately $180 million for stock-based compensation and amortization of intangible assets, and it assumes, among other things, that no additional business acquisitions or investments are concluded and that there are no further revisions to stock-based compensation estimates.

A conference call will be webcast live today at 2 p.m. PT/5 p.m. ET, and will be available for at least three months at www.amazon.com/ir. This call will contain forward-looking statements and other material information regarding the Company’s financial and operating results.

These forward-looking statements are inherently difficult to predict. Actual results could differ materially for a variety of reasons, including, in addition to the factors discussed above, the amount that Amazon.com invests in new business opportunities and the timing of those investments, the mix of products sold to customers, the mix of net sales derived from products as compared with services, the extent to which we owe income taxes, competition, management of growth, potential fluctuations in operating results, international growth and expansion, the outcomes of legal proceedings and claims, fulfillment center optimization, risks of inventory management, seasonality, the degree to which the Company enters into, maintains and develops commercial agreements, acquisitions and strategic transactions, and risks of fulfillment throughput and productivity. Other risks and uncertainties include, among others, risks related to new products, services and technologies, system interruptions, government regulation and taxation, payments and fraud. In addition, the current global economic climate amplifies many of these risks. More information about factors that potentially could affect Amazon.com’s financial results is included in Amazon.com’s filings with the Securities and Exchange Commission (“SEC”), including its most recent Annual Report on Form 10-K and subsequent filings.

Our investor relations website is www.amazon.com/ir and we encourage investors to use it as a way of easily finding information about us. We promptly make available on this website, free of charge, the reports that we file or furnish with the SEC, corporate governance information (including our Code of Business Conduct and Ethics), and select press releases and social media postings.

About Amazon.com

Amazon.com, Inc. (NASDAQ: AMZN), a Fortune 500 company based in Seattle, opened on the World Wide Web in July 1995 and today offers Earth’s Biggest Selection. Amazon.com, Inc. seeks to be Earth’s most customer-centric company, where customers can find and discover anything they might want to buy online, and endeavors to offer its customers the lowest possible prices. Amazon.com and other sellers offer millions of unique new, refurbished and used items in categories such as Books; Movies, Music & Games; Digital Downloads; Electronics & Computers; Home & Garden; Toys, Kids & Baby; Grocery; Apparel, Shoes & Jewelry; Health & Beauty; Sports & Outdoors; and Tools, Auto & Industrial. Amazon Web Services provides Amazon’s developer customers with access to in-the-cloud infrastructure services based on Amazon’s own back-end technology platform, which developers can use to enable virtually any type of business. Kindle, Kindle 3G, Kindle with Special Offers, Kindle 3G with Special Offers and Kindle DX are the revolutionary portable readers that wirelessly download books, magazines, newspapers, blogs and personal documents to a crisp, high-resolution electronic ink display that looks and reads like real paper. Kindle 3G, Kindle 3G with Special Offers and Kindle DX utilize the same 3G wireless technology as advanced cell phones, so users never need to hunt for a Wi-Fi hotspot. Kindle is the #1 bestselling product across the millions of items sold on Amazon.