Founder of KND and BookGorilla

Related links:

Sign up for FREE BookGorilla email alerts

Download the FREE BookGorilla app from the Kindle store

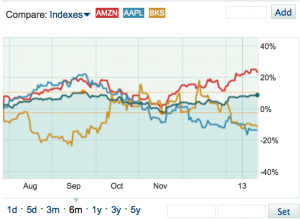

There’s been plenty of commentary focusing on a recent pattern of rising prices for ebook bestsellers — even, alas, in the Kindle Store. Our colleague and friend Bufo Calvin offered some clear analysis recently on his I Love My Kindle blog, under the headline Kindle New York Times bestsellers shockingly up almost $1 a month so far this year. And if that were the whole story, it would spell bad news for the budget-conscious avid readers that make up a major part of Kindle Nation.

It may![]() seem counterintuitive, but there’s also some great news for these ebook consumers, especially the growing number of readers who make use of free daily alerts from BookGorilla. To show you what we mean, let’s focus on the Top 100 Bestselling Books of 2013 in the Kindle Store, according to Amazon’s own full-year Kindle bestseller list.

seem counterintuitive, but there’s also some great news for these ebook consumers, especially the growing number of readers who make use of free daily alerts from BookGorilla. To show you what we mean, let’s focus on the Top 100 Bestselling Books of 2013 in the Kindle Store, according to Amazon’s own full-year Kindle bestseller list.

The average prices for those Top 100 bestsellers as of their release dates was $10.08, and their average price today, now that most of them have been out for a while, is $6.64 (see table). 30 of these books were initially priced between $10.99 and $17.99 — prices that most Kindle owners, according to our surveys, consider exorbitant. No surprises in any of that.

But here’s the good news: 71 of those same 100 books have been featured on the daily BookGorilla ebook deal alert during the past year, and the average deal price for those 71 books was $3.17.

So, if you had purchased those 71 books on their release dates, they would have cost you a total of $794.50 (an average of $9.78).

But patient, budget-conscious readers could have purchased all 71 books on the days of their BookGorilla specials for just $225.31. That’s a savings of $469.19 — well over $6 per book!

And far from being limited to popular self-published 99-centers, this list includes nearly all of the biggest books of the year, starting with 25 of the top 27 Kindle bestsellers of 2013, including Dan Brown’s Inferno, Gillian Flynn’s Gone Girl, Grisham’s Sycamore Row, and other blockbusters by J.K. Rowling, Lee Child, David Baldacci, Pulitzer Prize winner Donna Tartt and more.

Obviously, millions of readers paid those high, impatience-driven prices … not that there’s anything wrong with that. After all, how were they to know when these must-read titles would be available at discounts of 60 to 90 percent, especially when such deals are often available only for a day or two?

That’s where BookGorilla comes in. It’s a totally free ebook recommendation service that was launched 13 months ago by the same incredible group of folks who produce Kindle Nation Daily, an ebook community that we have been building since Amazon introduced the Kindle in November 2007. Since then, other ebook sites have jumped on the bandwagon, and ebook recommendation services, in particular, have proliferated.

But BookGorilla takes a very different approach.

BookGorilla is driven primarily by a unique ability to discover and share — in a very personalized way — the best deals every morning on the kind of top-tier A-list bestsellers mentioned above, along with very popular backlist titles and truly curated “discoveries” of the best books from small presses and independent authors.

Equally important, less than 20% of the ebooks recommended by BookGorilla are ad-supported. With a revenue model fueled by about 70% Amazon Associates fees and 30% advertising revenues, BookGorilla has a powerful incentive to deliver on one of its key slogans:

“Instead of pushing you to buy books that we want you to buy, BookGorilla shows you books that you actually want to read, at prices you never dreamed possible!”

It’s no accident that we launched BookGorilla just as a federal court brought an end to price-fixing collusion by Apple and five of the Big Six publishers. As a result of that change, the largest publishers themselves have joined in the same fierce price competition that was previously limited mainly to indie authors and smaller publishers.

It’s one thing to compete on price, of course, and another to get the word out about your best discounts. Now the ranks of BookGorilla’s advertisers include several Big Six and other major publishers, but whether or not a title is ad-supported, BookGorilla still enforces its same stringent price and quality requirements for “deal-worthiness.”

It is likely that the major publishers, and retailers like Amazon, will continue to price most books, most of the time, at very profitable levels: $8 to $15 for new-release bestsellers, and $4 to $10 for strong backlist titles. It’s up to consumers whether they want to pay those prices, and many are driven to pay them by impatience, the next book group selection or the demands of a course syllabus.

But for the significant number of readers who want to save a few bucks, the deals that BookGorilla recommends each morning mean that, with a little patience, readers can buy just about any book they might want, including very recent bestsellers, at much, much better prices.

The average price of all books on BookGorilla for March 2014 was $1.03. Given that there are no shipping charges for an ebook, that places the cost of buying Kindle books somewhere between the cost of using a public library and shopping at a used bookstore, for BookGorilla subscribers who use the service on a daily basis. As a result, budget-conscious readers may have a little less to fear in the pattern of rising bestseller prices that Bufo Calvin has described.