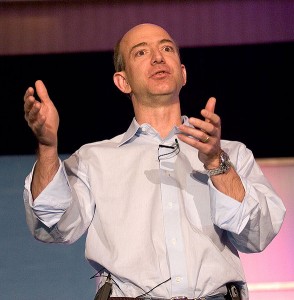

(Ed. Note: For any publisher or journalist, there are few things that feel as good as a great “get.” So this week, as we join contributing editor Len Edgerly in celebrating four terrific years of podcast interviews, we congratulate him for this week’s “get” of Amazon and Kindle founder Jeff Bezos, and we congratulate ourselves for our “get” of the highly esteemed Mr. Edgerly. –Steve Windwalker)

By LEN EDGERLY, Contributing Editor

I traveled to Seattle this week to sit down on July 26th with Jeff Bezos for an 18-minute conversation about the Kindle. We met in an unadorned conference room at Amazon’s fast-growing campus of nondescript buildings. He’d brought a dish of cottage cheese and a paper cup containing something to drink. As I tested the audio levels on my Olympus LS-10, Bezos offered this disarming advice: “Usually my laugh eventually blows out the microphone, so hopefully you’re set for that.”

In appreciation for this opportunity to better understand how the Kindle looks to the man who leads the team that created it, I am pleased to present the following complete transcript of the interview:

Len Edgerly: It’s been seven years since you did the early design for the Kindle.

Jeff Bezos: Yes.

LE: When you think back to what you saw then, what’s been the biggest surprise in how it’s all unfolded?

JB: The biggest surprise by far is how quickly it has grown. When we did this, we were very optimistic that Kindle would eventually be a success and that it would accelerate the adoption of eBooks. But what has actually happened, happened so much faster than any reasonable person would have expected.

Today eBooks have become a huge fraction of the books sold, and we wouldn’t have anticipated that. That’s a big surprise.

LE: It sold out in like the first hour and a half [it was actually five and a half hours]. At that point was it evident that this was going to be a faster ride than you thought?

JB: Yeah. We were very surprised right from the beginning. And all throughout that first year actually, we continued to be surprised. So you may remember that not only were we out of stock in our first holiday season, but we were also out of stock in our second holiday selling season. That’s not a good time to be out of stock. And so we continued to be surprised by the adoption rates. That’s a good, high-quality problem, but it’s still something that I look back on and marvel at.

LE: How has the Kindle changed your own personal reading habits?

JB: I think like a lot of our Kindle customers, the biggest thing is that I end up reading more. So, it’s just easier to read more. I can have more books with me. I travel. When I’m traveling I don’t always know exactly what I’m going to be wanting to read from time to time. I can also get new things when I want to, when I hear about them. So if a friend tells me about something, I can get it right away, or if I read about something in a blog somewhere, I can get it right away. I just read more.

LE: I’ve been surprised by how much I read on the Fire, because I was such a lover of the E Ink. What’s your ratio between reading on the Fire versus with reading on the E Ink devices.

JB: Well, I carry both devices, and I really like to read periodicals on the Fire. So magazines and newspapers—I find the Fire experience to be preferable. When I get into a long-form book, reading a novel, I really prefer the E Ink device, I think in part because it weighs less, it’s lighter. It’s easier on my eyes. For extended reading sessions and right before bed, I find I gravitate towards my Kindle, and then for lots of other things I use my Fire.

LE: What do you think will be the same five to seven years or further out about the way we read, never mind how the technology advances?

JB: I think one thing that you can count on is that human nature doesn’t change. The human brain doesn’t change. And so one thing that seems to be very, very fundamental is that we like narrative. We like stories. So I don’t think that any amount of eBook technology is going to change the fact that we humans like narrative. And so I think that linear narrative, where somebody has really put a lot of work into guiding us along in a great story—a great storyteller, that’s what they do. I think that’s going to stay the same.

LE: Do you think that at some point the all-text story will be kind of an historical anomaly because the digital editions, the enhanced audio video and all that will just create a more compelling experience of a story than all text?

JB: I doubt it. We sort of have done that experiment in a way already, because sometimes really good books get made into movies. And even if the movie is a good movie—there’s also the case where they get made into bad movies. But even if they’re good movies, there are things about the book that never get replicated in the movie.

And I think the all-text story, as you put it, is its own medium, and I think that is likely to continue. I don’t think, for example, that audio snippets would make Hemingway better. I’m not sure multimedia would make Hemingway better. So I think it’s its own thing.

Now will there be new kinds of things invented that take advantage of these new technologies? Yes. Just like movies, moving pictures, was a completely new medium. But you didn’t try to do books with moving pictures—they might be derived from a book. But it’s its own art form, and they had to invent all the things that make movies good—all the different ways from cutting from one scene to the next—and it didn’t displace books. And I think that’s what you’ll see happen here, too. There’ll be new kinds of multimedia offerings that people can interact with on Kindles, but they won’t displace all-text stories.

LE: When you’re reading an all-text story, your mind is filling in so much, and that’s part of the pleasure.

JB: Exactly. Part of the pleasure is that you’re imagining your version of that story, all the details and all the richness. And multimedia takes some of that away.

LE: Plus it’s kind of a distraction. There’s a thread that gets broken when you’re tempted to go somewhere.

JB: I totally agree. And I would also say that a lot of what makes long-form books such a good format is there’s a lot of inner dialog that can happen in a book that you can’t really capture in multimedia. It can’t just be a glance at somebody’s face. It has to actually be that whole thread of what’s happening inside their head.

LE: The two core features back in the early days of the design that you emphasized were keyboards for searching books easily and also the automatic 3G, so people wouldn’t have to mess with WiFi. And the two Kindles now don’t have either of those. So what changed there?

JB: The key thing about the keyboard is that the electronic ink display technology finally got fast enough and responsive enough that we could do a reasonable onscreen keyboard. That also ends up making the device lighter. But the big difference, the big change over time is that the electronic ink display technology has gotten faster and more responsive.

We do still offer our 3G version of the Kindle. And that is a very popular choice, in fact people who buy that Kindle are the people who read the most.

LE: Why do you think that is?

JB: I suspect it’s probably some that they are the more serious readers, so they want the very best Kindle. But we also see that their reading increases even more than people who buy the other Kindles. And the reason, I think, for that is that it makes getting books even more frictionless, makes it even easier. You don’t have to look for a WiFi hotspot. You can just get them wherever you happen to be. And it roams globally at no charge, so people can figure that out, too, and get it wherever they are, even if they’re traveling around the world.

LE: It’s amazing how that small of an additional convenience would translate into more sales and reading.

JB: Exactly right, and we see this in everything. Many years ago we did this thing called One-Click Shopping, and tiny, little improvements can drive people to do more of something, just because you’re making it easier. And we’re all busy here in the early 21st Century.

LE: You’ve innovated with steady improvements to the Kindle platform since the introduction in November of 2007. And, as you’ve said, not every experiment succeeds—otherwise it wouldn’t be an experiment. Which blind alley that you’ve gone down in the last seven years taught you the most about how your customers want to read?

JB: That’s a great question. I would say one example of that would be location numbers. So one of the things that we did early on is we looked very hard at page numbers and how should we deal with electronic books? How should we do page numbers? You have to keep in mind that when you change the font size, everything changes. So you can’t really just count pages or screenfuls. So we came up with location numbers, and location numbers are the same no matter what font size you set your Kindle to. And by the way, being able to change the font size is something customers love about Kindle. That, and looking up words—there are a bunch of little things that people really love. They seem like small things, but they’re actually big features that people use all the time.

So after working with location numbers for many years, we got lots of feedback from customers that there are a lot of use cases where they wished that they had page numbers that matched the page numbers in physical books. So, for example, if you’re having a book club, and some people have the physical book and you have the Kindle book, you still want to be able to refer people to the real page number. You can’t say to your friend, “Turn to Location, you know, 2015.” (Laughs)

And so we used our cloud-computing expertise and our machine-learning expertise, and we actually built a set of algorithms that can look at the scanned pages of physical books and match up the words and find with pretty high confidence when you’re on your Kindle, what is the real page number that you happen to be on? We’ve implemented that for many, many of the books now in the Kindle catalog.

LE: That was good, because even though I can’t feel the pages, to know I’m on page 200—there’s a reference to the way I used to read that’s helpful.

JB: Exactly. Because we’ve all grown up reading physical books, we have kind of an internal clock or something that keeps track in page numbers, and that’s much harder to translate into something like location numbers. Maybe it would be akin to trying to figure out how much something costs in Yen when you’re in Japan. You can eventually figure it out, but it’s not something that you can do with intuition.

LE: Do you think we’ll ever reach a time when 60 seconds just seems like too long to download a book?

JB: I can tell you that most of the downloads now take way less than that. So we advertise books in 60 seconds, but actually it’s much faster.

I can also tell you that one of the things that gets me up in the morning is knowing that customer expectations are always rising, and I find that very exciting. You know, this is a team of missionaries, and we like to rise to those kinds of challenges.

LE: You like to be a little bit ahead.

JB: Maybe it should be books in one second. (Laughs.)

LE: Whoah. I’d buy even more.

JB: Exactly. Very good.

LE: Now, Stephen King has been very future-leaning on eBooks. In fact he helped you launch the Kindle 2. I was disappointed, because his upcoming book, Joyland, is coming out in print only, and he was quoted in the press release saying, “folks who want to read it will have to buy the actual book.” Any idea what happened there?

JB: No, I don’t know what that’s about. I can tell you one thing, though. If you’re Stephen King, you can do what you want. (Laughs.) As you pointed out, he’s been a great friend of Kindle. He wrote some exclusive content for us and came to one of our press conferences, and he’s a very good guy.

LE: Compared with the Kindle Fire and the Kindle apps, the E Ink Kindles still maintain their role as kind of the Cadillac of purpose-built reading devices. There are things you can do on the E Ink Kindles that you can’t do on the Fire. Do you think the appeal of purpose-driven eReaders is likely to diminish as the all-purpose devices get better and better at reading?

JB: No. I think that for serious readers, there will always be a place for a purpose-built reading device, because I think you’ll be able to build a device which is lighter, which matters a lot to people, has better readability if what you’re doing is reading text. You know, as soon as you have to make a device do a bunch of things, it becomes suboptimal for doing the one thing. And so while I think the tablet, LCD devices like Kindle Fire will continue to get better and better and better, I think that purpose-built reading devices, like our electronic ink Kindle will also continue to get better and better and better.

Can you go hiking in tennis shoes? Yes, but if you’re a real hiker you might want hiking boots. And so both things, I think, will continue to coexist.

LE: You’ve said your passions choose you and not the other way around. Can you trace back the passion that led to the creation of the Kindle in your life?

JB: Well, I have been a lifelong reader. My wife is an author. We started Amazon with books. We are missionaries. All of our products here at Amazon, products and services, are built by missionaries. And I call it missionaries versus mercenaries. Missionaries build better products, because they’re not doing it just for the business results. They’re doing it because the love the product or they love the service.

And it turns out Kindle is a really easy product to attract missionaries, because a lot of people care about reading. A lot of people care about inventing the future of reading. And so it’s super-easy for me personally and for our whole team to be passionate missionaries about Kindle.

LE: Because of that love of reading.

JB: Yeah, absolutely! I think it’s the love of reading personally and it’s also that we on the Kindle team take it as an article of faith that reading is important for civilization. So we feel this powerful mission, and it’s exciting.

LE: Your mission is every book ever published in every language, available in 60 seconds anywhere in the world. How would the world be a better place if you achieve that?

JB: First and foremost, I would take it as an article of faith. I think if people read more, that is a better world. So I would posit that as an article of faith.

But, you know, we humans, we co-evolve with our tools. We change our tools, and then our tools change us. And if you look at the digital era, almost every kind of media as it’s gotten digitized, more people have been able to access it. And most of what has happened with the digitization of text has been on short-form, so it’s things like blog posts. It’s short articles, short newspaper articles and so on.

And really, until Kindle, nothing in the digital era really made it easier to read long-form. People didn’t want to read long-form on their laptop. We tried that actually. We offered eBooks to people to buy as PDFs and other ways. You needed an electron microscope to find sales. Nobody wanted that.

In that sense that we’re co-evolving with our tools, one of the things that Kindle does is make it easier for people to read long-form. I personally believe that that also means that people will have longer attention spans. You know, one of the reasons that people sense that attention spans are getting shorter and shorter, a lot of it is because a lot of the digital media are shrinking the scale of the media. So YouTube videos are eight minutes long, and blog posts are two paragraphs long. So it’s not surprising. If that’s what you consume all day, that’s what your brain gets accustomed to consuming. And Kindle helps to push in the other direction.

LE: Which has got to be a good thing just for understanding and knowledge.

JB: That’s exactly what I think.

LE: Last question. When you spoke to the graduates at Princeton, you asked what convictions would enable them not to wilt under criticism. That interested me, and it made me think of your willingness to be misunderstood within the publishing industry. What conviction, personally for you, do you hold onto to avoid wilting under the criticism that comes your way, specifically in the publishing arena?

JB: What I hold onto and what I tell our folks here at Amazon is, if you’re going to invent, if you’re going to do anything at all in a new way there are going to be people who sincerely misunderstand, and there are going to be also self-interested critics who have a reason to misunderstand. You’ll get both types.

But if you can’t weather that misunderstanding for long periods of time, then you just have to hang up your hat as an inventor. It’s part and parcel with invention. Invention is by its very nature disruptive. And if you want to be understood, if it’s so important for you to be understood at all times, then don’t do anything new.

Kindle Nation Weekender columnist and contributing editor Len Edgerly blogs at The Kindle Chronicles where you can hear his interview with Jeff Bezos in its entirety at 11:45 of this week’s Kindle Chronicles episode 208.

Kindle Nation Weekender columnist and contributing editor Len Edgerly blogs at The Kindle Chronicles where you can hear his interview with Jeff Bezos in its entirety at 11:45 of this week’s Kindle Chronicles episode 208.

helps unearth exceptional books and emerging authors for more readers to enjoy, using customer feedback and sales information from Amazon’s sites.

introduces readers to authors from around the world with translations of foreign language books, making award-winning and best-selling books accessible to many readers for the first time.

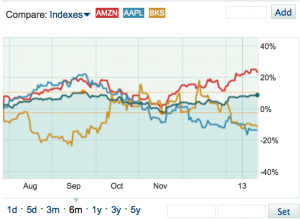

outstripped Amazon’s hardcover sales right from the drop, and a little over a year later Amazon announced that all Kindle editions were outselling hardcover units for the same titles, across the board.

outstripped Amazon’s hardcover sales right from the drop, and a little over a year later Amazon announced that all Kindle editions were outselling hardcover units for the same titles, across the board.